Any e-currency which is peer-to-peer must also be deflationary. Bitcoin, as “Immortal Deflationary”, presents the first real challenge to the established, “Coordinated Inflationary” currencies.

Introduction

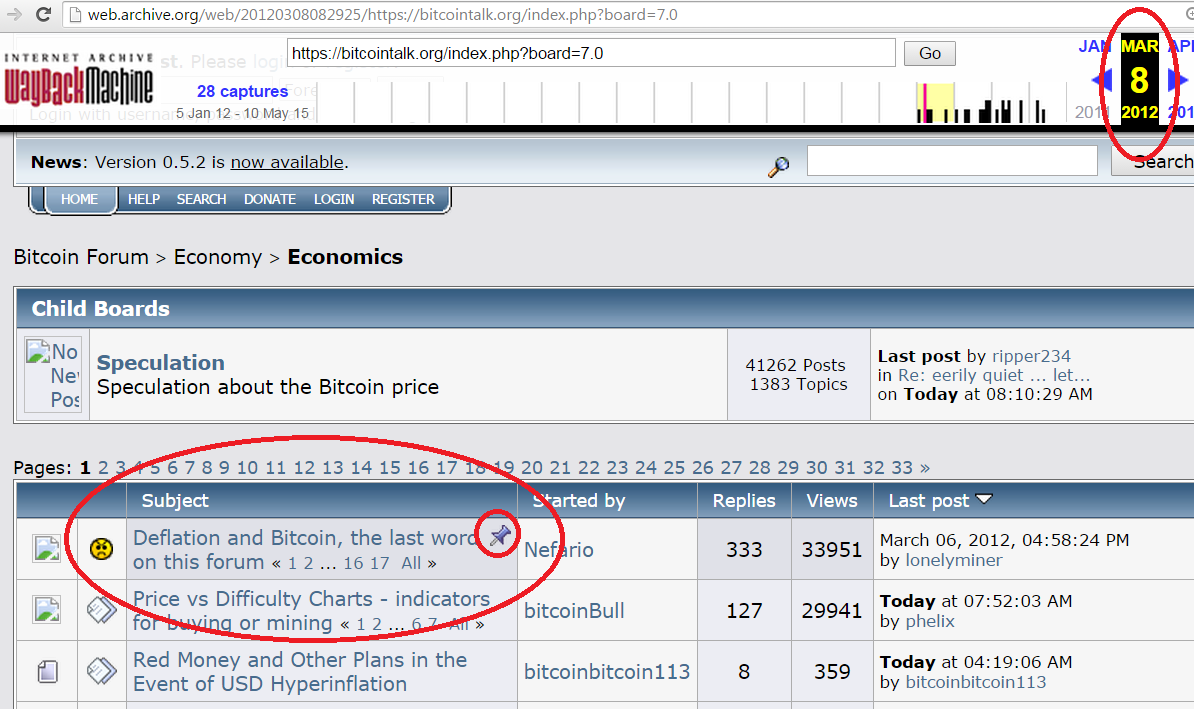

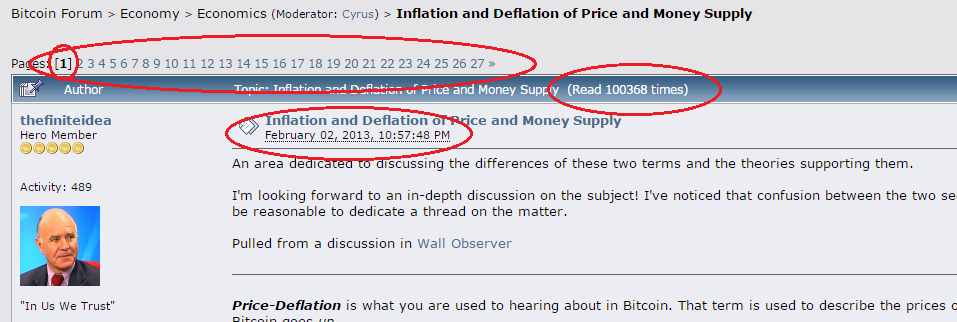

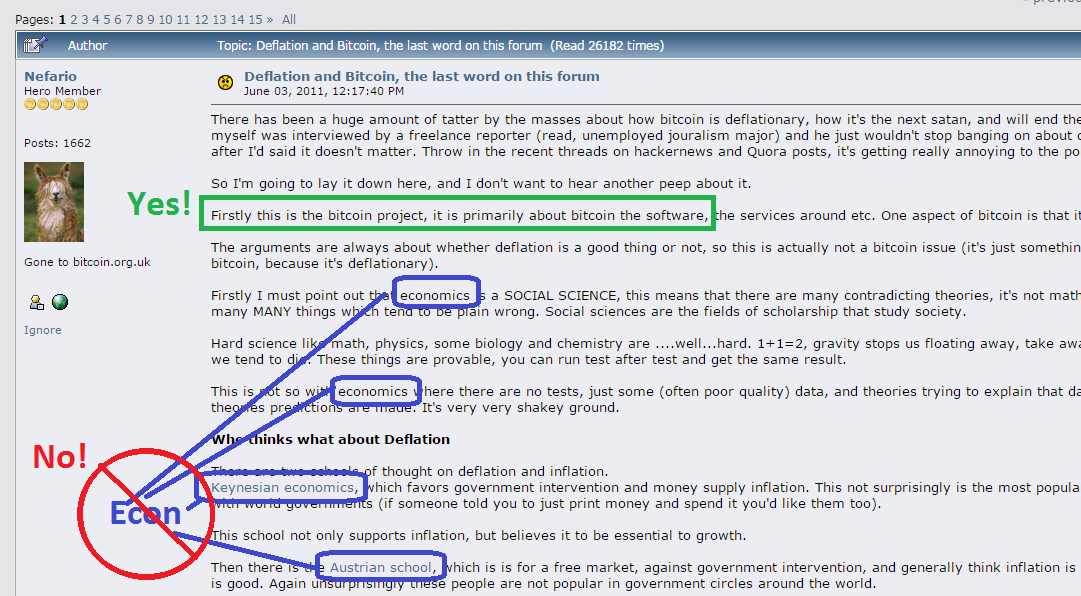

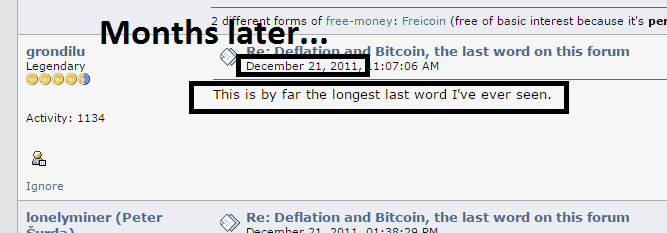

The debate seems endless, and wrong.

When I first got into Bitcoin (in 2011), I understood why it had to introduce coins gradually (the mining half of this previous post) and also why it had to ultimately stop introducing coins, hence the fixed steady-state money supply (the 21 million coin limit).

But other people didn’t…

…and still don’t.

Somehow, years later, the debate rages on, still by people who seem to think that the limited supply has something to do with macroeconomic policy. It does not.

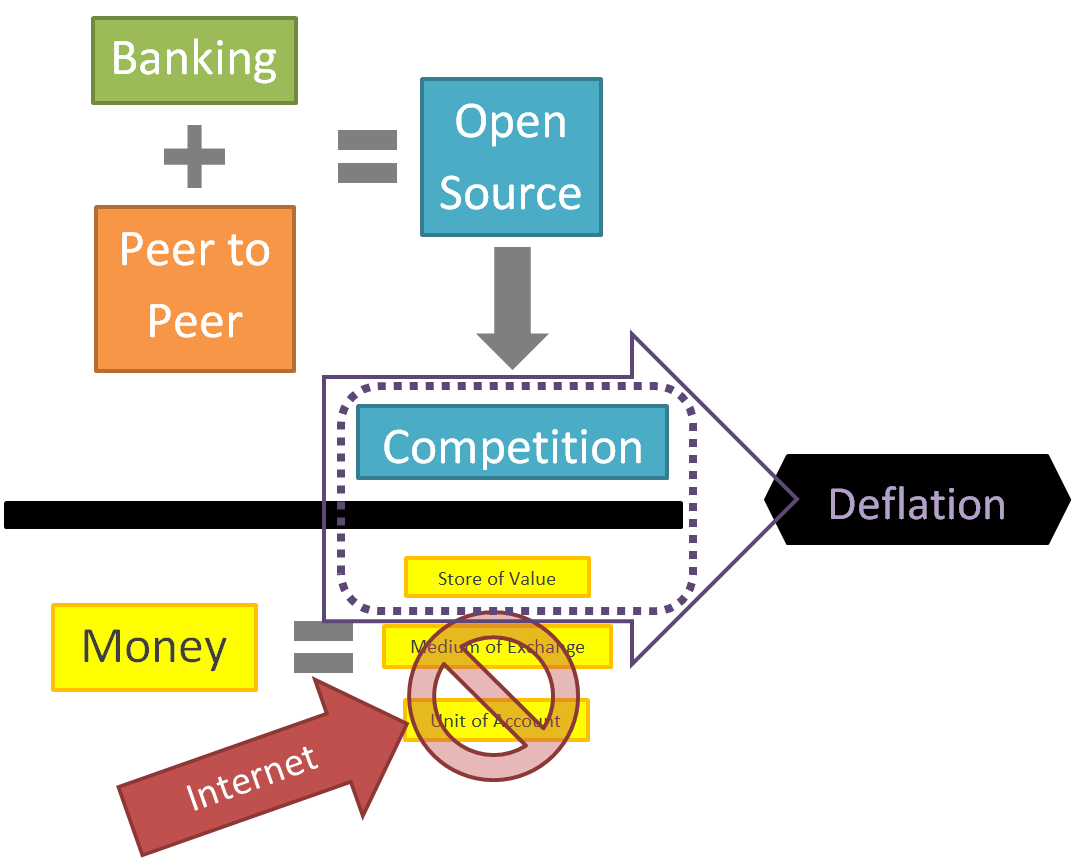

Inevitable Deflation: Three Puzzle Pieces

P2P e-cash systems without a fixed money supply will be replaced by P2P e-cash systems with a fixed money supply.

Puzzle Piece 1: Peer-to-Peer “Banking” Means Open Source

i. Security

First and foremost, people aren’t going to trust their money with something unless they understand how it works. People understand that banks work, and that online banking is just a different way of interacting with their bank, but with this newfangled “Bitcoin” software, transparent security is going to be imperative.

ii. Ownership

The major advantage to closed-source is that you can sell the software, or otherwise extract cash from its use. The P2P community isn’t into that: in fact, tons of proprietary software is itself (illegally) distributed over the P2P protocol Bittorrent every single day. The original “big” P2P software app was Napster, which fell into legal chaos by “owning” its closed source software, and therefore being legally responsible for the actions of its users. (Later, [open source / un-owned] implementations of essentially the same idea [Gnutella] are still around today).

iii. Unowned-Project / Volunteer-Based-Development Spiral

When the development and distribution of the software is itself P2P (ie, the software is designed, written, developed, and improved collaboratively), the gains from open source (onboarding, review, coordination of interested programmers) overwhelm the costs.

iv. Non-Administration

Contradiction: [1] All nodes are going to be equal (“peer-to-peer”), with no administrator nodes. [2] Under closed source, everyone is running the same application but only a few “administrators” know what the application is really doing.

Puzzle Piece 2: Open Source Means Competition

Open source software can be effortlessly copied. The copies can be trivially renamed, they can be trivially modified to use different colors, or words, or different starting parameters. It’s Darwinism at the speed of the information superhighway.

If you don’t know that, you don’t know anything about software, and you definitely don’t know anything about Bitcoin.

( Central Banks are designed to coordinate monetary policy for large areas [in fact, the world’s central banks have historically been born just-before/during expensive federal campaigns/wars/”coordination competitions”], but: the easier it is for someone to leave a group, the harder it is to get the group’s members to do something they don’t want to do. )

Puzzle Piece 3: The Winner-Take-All Network-Effects of Value-Storage

Citizens use only one form of money. Currencies spread as far as they can (usually until they reach rival-citizens who must pay rival-taxes in a rival-currency), and then compete until there is just a single survivor.

Basics of Money ( Please Skip If You Already Know )

Time passes. Some days you have not enough; other times: more than you need. People share to work as a team, and, in the past, used “memory” to keep track of who’d been pulling their weight. But, memory wasn’t completely reliable (biased toward beauty/authority, it only worked for people you already knew, etc.), so we chose a commodity to serve as community-effort-memory: money.

Which commodity would best transport value across time? The fundamental challenge is to acquire something now, that someone else will want later.

-

“Acquire something now…“ implies some kind of transact-able property: The cheaper to store and transport, the better (hence gold, with high value-to-volume and value-to-weight ratios, or the modern USD checking account, which only requires organizational safeguards, laws, and arithmetic).

-

“…that someone else…“ is more complex: What you save needs to be widely “recognizable” (to reduce the transaction cost of passing it to a new owner), needs to be of uniform-quality (aka “fungibility”, so that quality negotiations and assessments don’t slow down the transaction), and needs to lend itself well to changes in quantity (“divisibility”).

-

“…will want…“ implies some “fundamental” or “seed” value: That someone, somewhere, would definitely want this good all in itself (for some non-transaction reason). This disqualifies anything which is easily counterfeited (why take it from you if they can make it themselves), or which serves no useful purpose. Bitcoin and the USD derive their “fundamental value” from cheap, secure, storage costs (free checking accounts) and amazing message-transfer capabilities (compare the convenience and efficiency of internet signals, checks, credit cards, wire transfers, etc., to the inconvenience and insecurity of shipping bars of gold around the world).

-

“…later.” implies that you are passing the value through time: The ideal choice of money is “durable” (won’t “rot”, ie: won’t lose its quality due to changes in the atmosphere or ecology).

It is durability where Bitcoin holds the critical advantage. Bitcoin is inflation-proof, bailout-proof, it’s checking accounts are free, and accessible to anyone (criminals, oppressed minorities, children, schizophrenics, etc), and it is therefore nearly impossible to diminish the integrity of each monetary unit (“it won’t rot”).

“Recognized” as the Leader in Value-Storage…

People (individuals) want money, because people (as a group) want money. It’s quite circular. What drives this amusing little quirk?

Well, of all the things to save, one will be -objectively- best. Over time, individuals will recognize the advantages of this money-form, and start saving in it, purely for convenience. Eventually, they’ll transact in it (“Why do any more roundtrip conversions, or any more price-calculating/negotiating, than necessary?”).

Having two things serve as money is non-fungibility. It introduces complexities of an unacceptable nature.

…especially in the Information Age.

In fact, because modern computing [1] allows prices to be quickly and effortlessly recalculated and redisplayed, and [2] allows e-transactions to be fast and cheap, we have many options for fast roundtrip conversions that drastically reduces money’s need to serve as a unit of account or even as a medium of exchange. This leaves only value-storage as a discriminator among money-types.

Assembling the Puzzle

I hope it is now clear: if Bitcoin didn’t have a fixed money supply, it would be replaced by something which did. It would have happened with a single fork and a little publicity (rich BTC-owners could spread the following word “come with us on this hard fork at Date D, and your money will automatically be more valuable”). Since Satoshi knew that this would happen (and as non-equilibrium behavior doesn’t last long [by definition], and as hard forks endanger the digital-scarcity value-proposition / create double-spend opportunities), he built it the right way the first time.

Hopefully it is also obvious that something with a decreasing money supply also won’t work. If the supply is decreased uniformly across accounts, nothing of any consequence occurs whatsoever. How is a world where [1] Bitcoin values are cut by a factor of 1000 each year, different from a world where [2] each year, we shift our labeling scheme back from “uBTC” to “mBTC” to “BTC” to “kBTC”? This would not truly “be” a change in the money supply at all, instead merely a relabeling. If coins are destroyed randomly, risk of wealth-loss is introduced (pointlessly). As Bitcoin is anonymous/identityless, and, as users will react to protocol rules (to avoid coin-destruction), any non-uniform destruction of coins must, in practice, be a random destruction. Therefore, a decreasing money supply harms the cryptocoin-project unambiguously.

Demurrage currencies (such as Freicoin) are fundamentally uncompetitive for exactly the same reason: money exists to be saved, the savers are better off on the fork which most encourages saving.

Coordination-anxiety magnifies the open-source “fork-the-project-and-leave threat” spectacularly: if some people have a reason to move to a different cryptocoin system, and you fight them (perhaps by selling the new fork [which they can do to you, by the way; a battle fought by savers with armies of stored-value]), you run the risk of losing all of your money. Better not to fight at all, and wait it out…but –ignoring network-effects– when selling your goods/services for cryptocoin, which of the two coins are you (a brand new saver) more willing to accept? The coin which preserves its value better.

Deflation: Beyond “Good” and “Bad”

People who criticize Bitcoin for being deflationary seem to have missed a number of more important things. Policy is primarily caused by what is possible and effective, not by what is desirable.

“Should” vs. “Will”

Bitcoin, as a protocol, is immortal. We can choose to ignore Bitcoin, but it cannot be shut off, it cannot be destroyed. Regardless of how we feel about it, it is here to stay. Bitcoin might cause permanent deflation, it might cause mass unemployment, it might cause famine, or cause the water of the Nile River to change into blood or trap the whole universe in an endlessly repeating loop of Thursdays.

Who. Cares.

Some people ask the question: “Should Bitcoin, a deflationary currency, be used as money?”. The question is completely irrelevant. Instead, ask: “Will Bitcoin be used as money?”.

The will and should questions are usually quite related, of course. If something “should” not happen, then it likely “will” not happen: we’d eventually prevent it from happening. If that weren’t happening, if a group of “preventors” for a should-not-happen didn’t exist, then we could start one and attract members. After all, we’re doing what should be done; we’re the heroes and everyone loves us.

But, in this case, “should” doesn’t matter.

Deflation is Now Inevitable

Inevitable = Your Opinion Doesn’t Count

It starts pretty bad: some economists argue that inflation is badly measured (yes, that’s the CEO of the St. Louis FED), others argue that inflation can’t be measured at all (yes, that’s monetary policy expert Scott Sumner), others argue that the theoretical aggregate supply/demand curves used to determine “the price level” aren’t monotonic and don’t uniquely intersect (from a Member of Table 1).

Okay, let’s ignore all of that and assume that you can prove that “deflation” exists, and let’s say that you can prove that deflation is bad. I don’t care.

In a few billion years, this entire planet will be incinerated by the Sun and obliterated completely. And I’m about 50% certain that our species will exterminate itself sometime in the next 200 years.

I’d start with those, if you have a magical way of dealing with sad truths. This one might not even be sad, it might be happy.

“But”, you say, “surely we don’t need to use this Immortal Bitcoin? We can just ignore it.”

If everyone was willing to ignore Bitcoin, that might be true.

The Long Run Belongs to the Best Savers

The only threats to Bitcoin’s survival are technical: mainly, that something will prevent Bitcoin from scaling. Scalability debates rage on, but progress has been adequate.

If Bitcoin’s transaction costs remain sufficiently low, every online merchant will accept Bitcoin round-trip, as this results in them getting more fiat cash. Even if transaction costs increase, no payment system on the market operates at Bitcoin’s speed, reliability, and privacy levels.

Assuming it does survive, it’s exchange rate (USD/BTC) against traditional, inflationary fiat currencies will move upward forever.

That sounds bold, doesn’t it? Like I must have violated the EMH or something. But proving it is easy: first, a perpetually rising exchange rate is really just another way of saying ‘deflationary currency’…just re-price the dollars with Bitcoin numéraire like everything else (BTC/$) and assume that that price will always fall (the inverse price must, then, always rise). Secondly, you can profitably arbitrage from BTC-purchases, for as long as the public remains ignorant of the benefits involved in using Bitcoin (fully consistent with the EMH). Thirdly, one can escape the generalized EMH argument (via Jensen’s inequality) with rare (but in this case realistic) expected-value and utility functions: because there is little to be gained by owning more than, say, 1000 BTC, individuals who own >1000 BTC could plausibly believe that the $/BTC rate will increase, and yet not be buying. If these >1000ers had any uncertainty about their exchange-rate beliefs at all, even selling BTC would be consistent with this belief. So, perhaps uniquely in the world of finance, it is possible to for a whole group of behaviorally-honest people to claim that the BTC/$ exchange rate will move downward forever.

We can dive deeper into the actual reasons for this specific price-decline: let’s consider the supply and demand fundamentals. Money, emphasizing digital scarcity, and relativity, doesn’t really have a supply “curve” (the supply is frozen at 100%), nor does it have a demand curve (as money represents stored value, a high price is exactly as bad as it is good – no curve at all). Changes in unit quantity tend to be directly offset by changes in price-per-unit, what matters is the product of the two: the market capitalization.

So, we are comparing money-alternatives to each other (re: winner take all network effects) on their money-merits (discussed above). Private increases in the supply of money are, as is near-universally acknowledged, a tax on holders of nominal money balances (and their associates) and a subsidy to debtors (and their associates). Revenue from this tax can then be spent/invested, and these purchases may affect the economy in innumerable ways, depending upon which purchases/investments are made, the circumstances under which they are made and the expectations that result.

No one likes losing money: everyone likes gaining money. By controlling the money supply, central bankers take from some, give to others, and alter the macro-economy in countless ways. For the greater good? Who cares. Because it isn’t happening any more: the inflation tax is voluntary, you only pay it if you save in US dollars. Today, people use dollars because they are the best medium of exchange, and an acceptable store of value, but in our future internet world, everything is a superb medium of exchange, and Bitcoin always outcompetes dollars as a store of value.

“Don’t Fight the FED”

Central Banks are for War.

Sometimes literally; but what I really mean is that the CBs represent coordination and leadership. All the users of a form of money -all of them- can be tapped to serve a single, unified purpose, and they can be tapped in a uniformly parasitic way: as little as possible from each, and never enough to kill the host(s). The US FED is like a general which commands a perfectly-obedient army of permanently-healthy dollars. With just the option to use that kind of power, you can do a lot.

I bring this up to explain why, if deflationary currencies are so powerful, we haven’t seen one take over recently. Coordination can be very useful, and banking-coordination probably helped to create/popularize checks, wire transfers, online banking, electronic tax filling, etc. It may even have helped win various Important Wars or fund Important Federal Projects, or maybe it just planted a flag in the ground that said “come to the USA, where banking is Definitely Good-Enough”. Its easier to rely on a banking network that has one person that you (or, just, that someone) can meet and negotiate with, who sets the rules, and can, at the the drop of a hat, move the whole network in a single direction. The US FED, Courts, Congress, and Armed Forces are all partners (more coordination). Most banking networks today are insecure; they aren’t exploited because fraud/hacking is illegal and you’ll get sent to prison. If the banks refused to ally themselves with their governments, how expensive would it be to run a branch, or cash a check? Banks store value, which means more can be lost than owned. Only violence can dish out a level of punishment which is significantly discouraging.

It is easy to see why, once one country “Central Banked”, all others followed: it’s a coordination arms race (try winning a war without one). In any arms race, everyone involved would prefer to live in a world where “arms” are permanently, globally, impossible: no one needs to spend money on arms, and everyone is perfectly safe. Bitcoin is the first technology, that enables such a transition to a permanent, global, un-Central-Bankable money: you get more or less what you had before, but a better store of value. ( Gold can never again function as money, it is too hopeless as a medium of exchange: expensive to transport, secure, and count. This has been true for as long as the internet has existed, and probably even for as long as the credit card has existed. )

Conclusion

Economic analysis is often journalism (“a persuasive organization of cherry-picked facts”), not science (“a process of ever-increasing predictive accuracy”); I was not surprised to see that econ-based arguments failed to achieve a “last word”.

Here I’ve tried to justify the thesis “e-cash will inevitably tend to a fixed money supply”, purely on tech/competitive grounds, and analyze the consequences of a fixed money supply for individuals instead of aggregated groups.

If you think I succeeded: