Probably not.

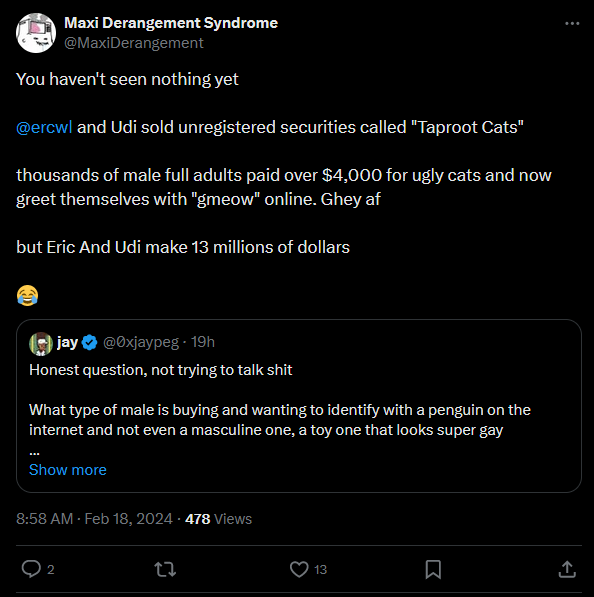

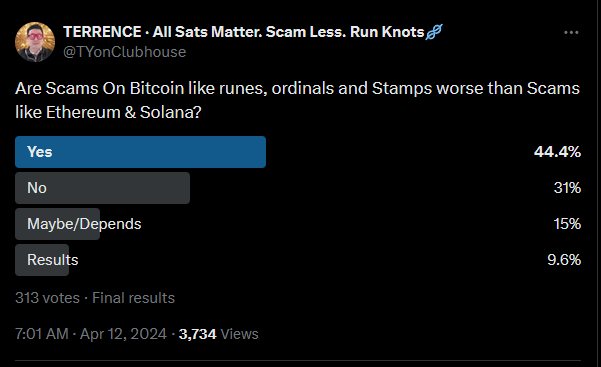

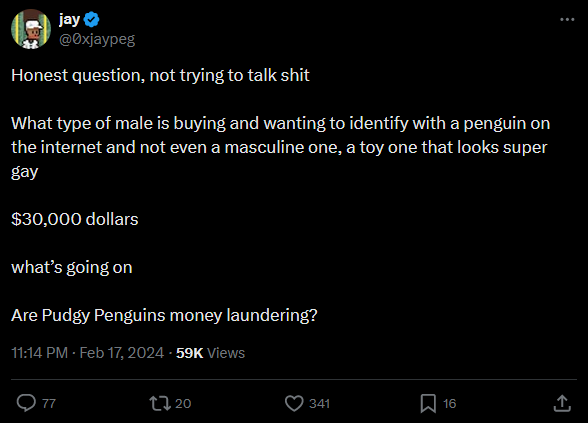

1. The Haters

These days, many hate NFTs/ordinals.

And – how different the haters are, from each other!

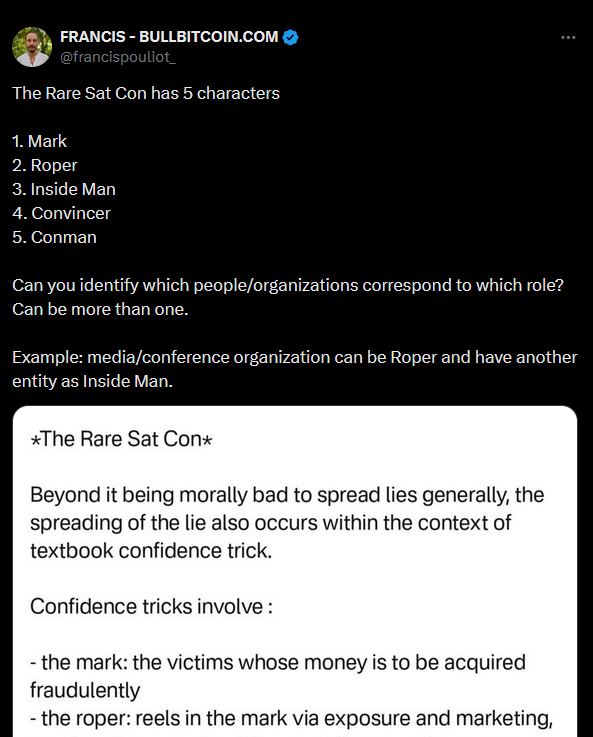

Swan leadership are lowest-of-the-low – no surprises there. But Francis Pouliot is basically a genius. (He is a S2F hater, at least.) And Casey is the creator of ordinals! Yet both seem to agree: ordinals have no purpose.

Even South Park paints them as useless and/or dangerous.

I guess it must be true, right?

2. The “Fun” Thesis

Even big Ordi-haters, admit that Ordinals are “fun”. (Or, they seem to, anyway.)

Seems straightforward. Kind of like gambling, right?

Is that the only point of ordinals?? Recreational gambling? (Which a small critical mass of people will take too far.)

No! The real value is hiding in plain sight:

- Taxes

- Mixing / Banking

- Boosting BTC

- Virtue Signaling / Revenge

3. Taxes

Digital Assets allow you to lower your taxes.

Yep.

From /r/conspiracy.

The above image is an oversimplification. But there is more substantial research fleshing out this use-case, for any who care to read.

The two obvious strategies, are:

- Turning illicit income, into “clean” ultra-low-tax capital gains.

- Creating fake losses for tax-loss-harvesting.

NOTE: Dear Mr. IRS Agent. I do not use these strategies, nor have I ever used them. My tax return will show that I have only ever claimed to have owned/bought/sold BTC. Truthfully this post was made, out of pity for the pour souls who are so “angry” about ordinals/NFTs, and so baffled by their continued presence.

A. Clean Capital Gains

First, why don’t you let Saul Goodman explain money laundering:

You want to keep your money, and your freedom?! Cause

I got three little letters for you -- I.R.S. They can

get Capone' -- they can get you.

And we can do much better than Saul.

For starters, Goodman charges 17%, just for brokering this deal in the first place. Seventeen off the top.

Then, Goodman wants Pinkman to pay regular income tax rates.

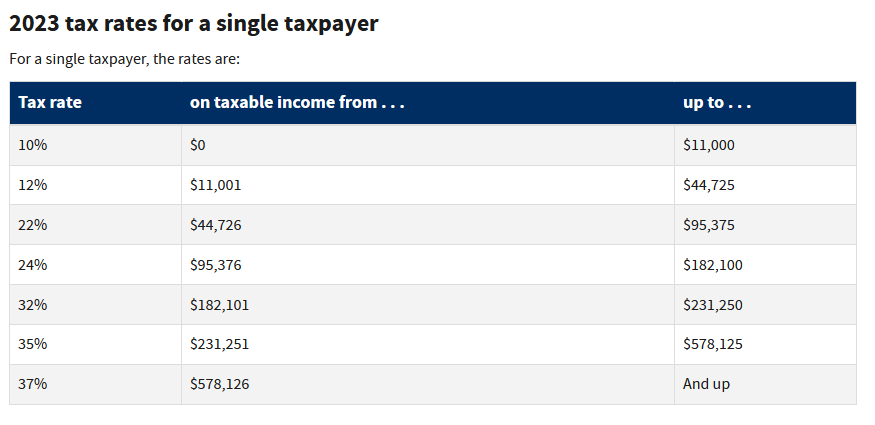

Here they are:

And those are just the federal rates. In Albuquerque, NM, if Pinkman wants $200k to come out of the Laundry, he’ll have to put $303,100 in. He will pay $73,132 Federal, $15,255 FICA, $14,686 State – $103,073 total. (So, with Goodman’s 17%, he will give $365,181 to Goodman to get $200k clean.)

Instead of the nail salon, Pinkman can just launch PinkCoin.

Since he is the (anonymous) issuer, he controls the supply, and the market. Now, the steps are:

- Cook crystal meth with Walter, earning $365k in drug sales.

- Make two fake internet personalities: “CoinSmith”, and “WhaleLambo” (both of these are Pinkman).

- CoinSmith creates “PinkCoin”, with a supply of 100,000,000 – all owned by him.

- Jesse Pinkman [a real person with a Tax ID / SSN], purchases 365,000 PinkCoin, from CoinGenius (who is also Pinkman) for $000.0001 each. Total cost $36.50.

- Pinkman holds these coins for a year. (Or pretends he does, knowing [probably] no one will dispute his story.)

- Pinkman sells the 365,000 PinkCoin to “WhaleLambo”, for $365,000.

- Pinkman pays capital gains tax.

Instead of ending up with $200k (and a pointless nail salon), Pinkman will end up with $305k. Capital gains tax rates are among the lowest. Even on a high income like $365,000 – they are just $52,055 federal $7,963 state, leaving Pinkman with over $300k.

And he could do it all from the privacy of his own computer. He even has cryptographically verifiable recipts of his transactions – complete with digital signatures and on-chain timestamps. No other people were involved – no one can rat him out (for the 15%-30% whistleblower award). No one can contest his story. No one even knows that anything happened. There are no phone lines to tap, no credit card machines or bank accounts to examine – why should some IRS bureaucrat get involved? They will be as baffled by PinkCoin as everyone else.

B. Tax-Loss Harvesting

I have just shown how Pinkman can lower his taxes, by manipulating the NFT/ordinal price up.

He can do the same, by manipulating the price down.

First of all, this can be done in a perfectly innocent way, but anyone who ever lost money trading NFTs. I’m far from the first to figure this out! See articles here and here. And people even sell this as a service: NFT Loss Harvestooor, Unsellable NFTS, TokenTax.

However, this innocent principle can also be maxxed out, in a dishonest way.

In fact, Saul Goodman explains the way (to Walt and Skyler, this time) in his next scene after the Nail Salon (two episodes later, at 10:05 here):

I know a couple of casino managers who will

jump at the chance to report false *losses*.

It's a win-win for everyone!

Here’s the dishonest version:

- Saul Goodman is a lawyer, making $450,000 a year.

- But, on paper, he becomes “Ice Station Zebra Associates” – a combo “Law Firm + NFT investment fund”. He’s going to have a bad year on the NFT side, to offset his profitable Lawyering.

- (Reminder from Step 6 above) Saul’s friend –Jesse Pinkman from the 1st example– has just sold 365,000 PinkCoin to “WhaleLambo”, for $365,000.

- “WhaleLambo” sells these PinkCoins to “Ice Station Zebra Associates”, for $450,000. The “price” then “tanks” – ISZA sells the PinkCoins back to “CoinSmith”, for $36.50. Now, ISZA has lost about $450,000, which offsets Saul’s earnings.

It looks like ISZA made only $36.50 this year – they pay no income tax. Despite truthfully earning $450k.

How does Saul get his $450k, you ask? Easy – ISZA never actually paid “WhaleLambo”. (WhaleLambo isn’t real.) Instead, they paid Saul (or some other holding company of Saul’s). Remember: Pinkman couldn’t care less about PinkCoin. Both he and Saul agree it has no value.

4. A Decentralized Mixer

A. Chain-alysis

BTC are often “mixed” to avoid chainalysis.

Mixing goes like this:

- You start with 10 “dirty” BTC.

- You put them into a system.

- The system gives you 10 BTC, with a different UTXO history. You pay a small fee.

A mixer is best, when (1) the coins are harder to trace, and (2) the fee is low.

B. NFT/Ordinals Market as a Mixer

An NFT/ordinal market, certainly provides the 1st – it has lots of different people, buying and selling. There are young/innocent/”artistic” people “mixed” in, with the hardened-criminal money launderers.

As for the 2nd? The fee? Well, in this case the fee is random. What do you get, when you sell an NFT? The price you paid? A lower price? A higher price? No one knows.

But I would like to point out: NFT-buyers seem to care very much about its historical price. A “hot” NFT has a high price, seemingly justified by a previous collector – who bought it for a high price.

This is a feature of collectibles.

C. Hayek’s Dream of Competing Currencies – Realized at last!

What would the ordinals hype be… if BTC were perfect?

In other words, if BTC were: infinitely scalable, cheap, private for 8 billion people.

I think the ordinals hype would be about 99% lower.

Nick Szabo, in his famous essay Schelling Out, suggests that “art” is a substitute money (pages 15-16):

A novelty of the 20th century was the issue of fiat cur-

rencies by governments. ("Fiat" means not backed by

any reserve commodity, as the gold- and silver-based cur-

rencies of previous centuries were). While generally ex-

cellent as a media of exchange, fiat currencies have proven

to be very poor stores of value. Inflation has destroyed

many a "nest egg". It is no coincidence that markets in

rare objects and unique artwork - usually sharing the at-

tributes of collectibles described above - have enjoyed a

renaissance during the last century.

Hayek dreamed of a world with competing currencies.

If we take a step back, and take a deep breath… we can prepare ourselves to grasp a profound truth: Bitcoin is an NFT. NFTs are coins. All collectibles compete, as money-substitutes.

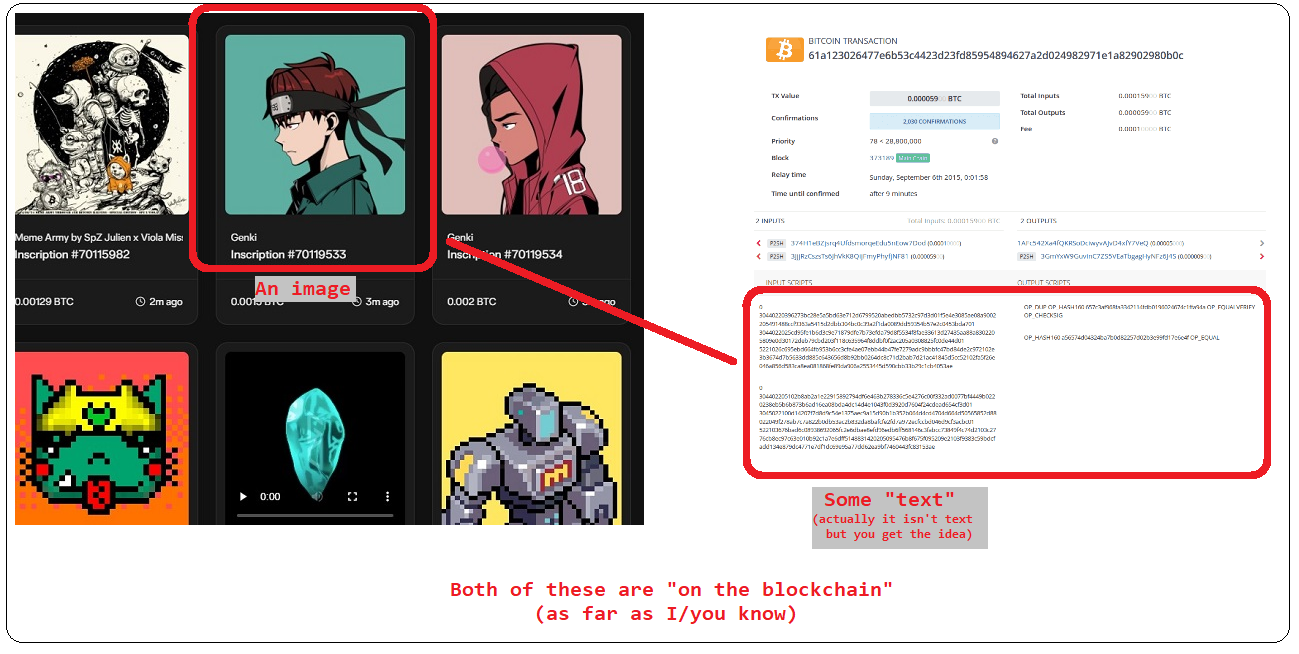

Instead of “jpgs on the blockchain”, BTC is “text-txns on the blockchain”.

From the computer’s point of view, they are no different. Some are –of course– better at being money than others. But among the many sources of NFT-value, Bitcoin’s flaws would make the list.

So, don’t whine about BTC falling behind, and losing the competition – instead, improve and compete harder.

5. Boosting BTC

Do other coins really help Bitcoin?? There’s no way to know for sure, but many Bitcoiners of today, first found BTC via other coins.

Let me put it to you like this: imagine you are Satoshi. In secret, you’ve mined another 2 million coins (in addition to the 1.2M that everyone knows you own).

You have more money than God – and no one knows it.

You really want Bitcoin to succeed. But there are only 24 hours in a day – not enough time to research every idea. You’ve spent the last few years watching all kinds of fringe ideas (Solana, TRON, USDT) explode and become worth hundreds of billions of dollars. You see complacency and overconfidence in BTC, perhaps spelling its demise.

So – you just throw money everywhere. Anyone who is doing anything – you give them money.

You want to avoid a mining death spiral, at the halving? So – you just invent an excuse to give them way more than 3 BTC per block – (for a short while, at least).

You want people to run nodes? Money.

You want developers to try new stuff? Anything touching anonymity, anything related to having fun, anything outside of the Core Death Cult. You just throw the money at it! Hit the gas.

You want to get attention? Just throw money at anything – anything that is succeeding on that front.

(And, this could apply to any mega-Bitcoin whale, not just Satoshi. Many of the early BTC whales, such as Roger Ver, behaved somewhat along these lines.)

6. Virtue Signaling / Revenge

It’s all just so predictable!

The Culture War's Shiny Object Cycle

Here is how it goes:

1) Some woke news story hits the press.

"Cats suffer from racial discrimination or screwing in lightbulbs

needs to be recognized as a valid sexual kink or something."

2) The Right Wing antibody response activates.

"Look at how insane these people are. *Matt Walsh quote tweets

the article and calls it obnoxious* This is the problem with our

convenient, decadent, TikTok society."

This reaction causes the story to gain infinitely more traction

than it ever would have done by signal boosting the original

fringe-scenario into a much bigger event.

3) The Left Wing counter-response activates.

"Right wingers lose their minds over one woman with a

particularly dark cat. The Daily Wire has meltdown over

insignificant troll article."

In times where the original story is less insane, this includes

a defense of the original article too. "Cats actually CAN

experience trauma, minimizing this is the REAL problem."

4) The Right Wing re-reaction kicks into gear.

"Apparently I'm insane for pushing back against Cat Trauma. See

this is the problem, if we don't stand our ground, these blue-

haired idiots will take over the country."

5) Finally, the Touch Grass Meta-Reactionaries steam in.

"The real issue is people talking about this issue. Look at how

silly this whole thing is. It's time to check out of the culture

war. We should reconnect with what really matters. You should

move onto the ranch next to Ryan Holiday and hammer fenceposts

into the ground for the rest of time."

This cycle is banal.

It's excruciatingly repetitive.

Above: Commentary on culture war.

Most outrage on social media (>50%) is a performance.

Some people are using it as a kind of marketing/advertising. Some use it for their egos. Some are addicts, hooked by Casino-grade PhD-psychologist manipulation. Some people are trying to impress friends, or potential future allies, etc.

We can predict that “ordinal hate” will continue. That is clear.

However, this does not mean that “ordinals hate” is justified. It does not actually mean that ordinals should objectively be hated.

If anything, the reverse. They are probably a better idea than they appear, since they have fallen into a Hatred Spiral that is fueled (and fueling) all kinds of ulterior motives. Even the haters are benefiting – what is the mountain-climber without the mountain?

Plus, think of all the super-rich people in this industry, who all hate each other and want revenge! For all kinds of real and imagined past transgressions. The knives are out!

Conclusion

Perhaps, NFTs/ordinals are short-lived fad. But –given that Meni Rosenfeld first published “Colored Coins” in 2012– that “fad” seems very long-lived.

NFTs do achieve real-world purposes – enhancing “privacy” for some people. Many insiders are aware of this, but avoid spelling-it-out – for the obvious reasons.

(Dear IRS, I hoped you learned something from reading this blog – if this info leads to additional tax revenues, I believe I am henceforth entitled to 15% under your whistleblower program. [Or maybe Vince Gilligan is.])

Some people out there, are just a little too eager to hate. They are mentally unwell, creepy weirdos. They are bitter that Bitcoin is not (yet) money. And –crabs in a bucket style– they are bringing down the mood.

comments powered by Disqus