The BitUSD isn’t very useful, should NOT be worth exactly $1 at all times, and (like all assets) requires fundamental value. Truthcoin might indirectly create BitUSD as a result of the USD’s inability to be used in prediction markets.

“BitUSD” is the concept of a cryptoasset with a fixed USD-value (instead of the current floating value). It therefore resembles traditional/pre-Satoshi e-cash schemes.

Interest in the BitUSD revived in early 2013, and is now re-reviving in early 2015. As usual, my take (emphasizing economic-viability) differs from most.

Is BitUSD Useful?

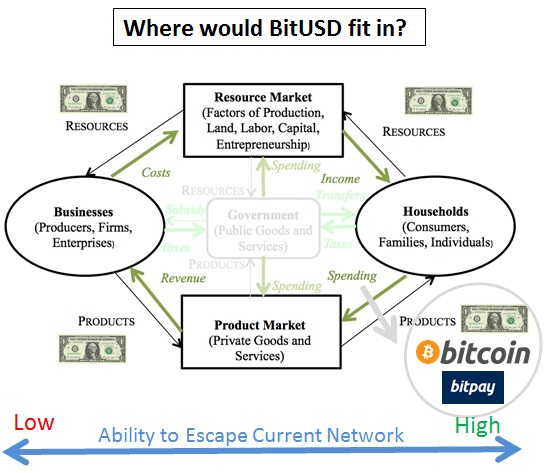

BitUSD is not useful for spending, where it is permanently inferior to both (Bitcoin + Bitpay) and the real USD. BitUSD is only useful as a mixed-bet investment: pro blockchain-tech, but against Bitcoin’s exchange infrastructure and monetary policy.

Problems Solved By BitUSD

Big Problem: Some Just Can’t Use Bitcoin As Money

Bitcoin’s price is famously volatile, occasionally falling by ~30-50% in a single day. This volatility is a barrier to adoption: not everyone can afford to bear large risks to their savings. Money is a network-effect on stored-value, but the network’s growth is slowed by adoption-barriers such as volatility. A BitUSD would help to remove this adoption-barrier.

Medium Problem: RealUSD is (Partially) Obsolete

The RealUSD, being integral to the day-to-day life of millions of people, must be conservative or even anti-innovative: “improvements” to the USD can’t be rolled out, unless there is a 0% chance of inconvenience. After decades of non-innovation, certain RealUSD players (credit cards, Western Union, checks, etc.) have reached the end of their usefulness: they’re too slow, too restrictive, and too expensive. Time to replace them.

Small Problem: Breaking Into the USD Network

Everything sold in the US is priced in US dollars. Moreover, these USD-prices are indifferent to the USD/BTC exchange rate, implying that -for Americans- Bitcoin is not (yet) a store of value or unit of account (although one day it will be). Americans can live in two currency networks at once (the geopolitical USA and the Internet), and so a BitUSD might help blockchains to “invade” the USD-network from their fortified position in the internet-network.

Not Solved: Decentralized BTC to USD Exchange

People really want to trade BTC for real USD. A blockchain-based BTC to BitUSD bridge does not solve this problem. Instead of “How do I swap my slow, reversible, mainstream USD for BTC?” we have (the equally difficult) “How do I swap my slow, reversible, mainstream USD for BitUSD?”.

Not A Relevant Problem: Merchant Adoption

Merchants are parts of large networks (suppliers, owners, employees, customers) and do not acquire marketable assets (instead, these assets accrue to their owners). As a result, they cannot easily coordinate a network-scale payment system upgrade. Merchants need USD, they can use Bitpay (which integrates with existing supplier/banking networks) to accept cheap blockchain-transfers.

And, as previously written, if BitPay were to enable merchants to accept both Bitcoin and BitUSD, this would only deepen Bitcoin’s relative advantages over BitUSD (BitPay’s transactional expenses are a direct function of market liquidity, which favors Bitcoin’s larger, more established market).

The “Bitcoin Put”

BitUSD, then, solves the problem of value risk. BitUSD is insurance, which protects users from bearing “too many” risks at once. Individuals are willing to invest in the blockchain payment technology, but they do not necessarily also want to invest in: [1] a new and volatile currency-system, [2] the first completely virtual (“un-backed”) digital money, or [3] the pseudogold monetary policy of Bitcoin (21 million coins, released every 10 minutes, halving every 4 years, etc). BitUSD allows users to separate those risks.

BitUSD: Useful Only for Savers (Not Spenders)

The value proposition of BitUSD is not “USA-cash on a blockchain”. As BitUSD is new, and unrecognizable to most people (most payment-systems), it doesn’t have “the purchasing power of a dollar” (you literally can not exchange it for a dollar’s worth of stuff). BitUSD is not for spending, it is for saving/investing.

Should 1 BitUSD Really Be Worth 1 USD?

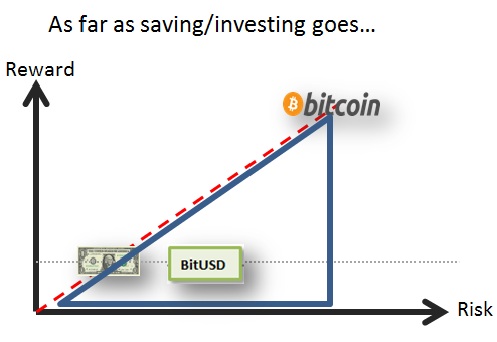

No. BitUSD is risky for savers, so a viable BitUSD would provide a positive investment return. This return must be set dynamically by free exchange in order for the BitUSD market to clear over time.

Even assuming that BitUSD were only used for saving, it would still have many disadvantages relative to the USD:

- Recognize-ability (Not recognizable as money, even to Bitcoiners.)

- Acceptability (Merchants do not accept BitUSD, and have no reason to.)

- Technical Risk (Software bugs, new attacks.)

- Social Risk (Cascading doubt, loss of confidence, BitUSD has no reputation as money.)

- Project Risk (“Will anyone still be interested in BitsharesX/Truthcoin when I want to sell?”, Pseudo-counterparty risk.)

- Regulatory Risk (What would be the USA-govt’s response to BitUSD, vs. a global Bitcoin.)

- Time Value of Money (Trapped funds should earn the prevailing “risk-free” interest rate.)

It is impossible to eliminate these fundamental risks, so individuals must be compensated for bearing them.

Above: The red dashed line represents the Risk-Reward trade-offs available to someone who can mix together “Nothing”, “RealUSD”, and “Bitcoin” in various percentages. Everything in the blue triangle is, by definition, inefficient. From it, one can always move up-and-left for a more-beneficial but lower-risk portfolio. It is foolish to own anything in the blue triangle.

Clearance Sale on Defective BitUSD

Track, But Don’t Hit

BitUSD should track its target (that’s what makes it useful as insurance). However, BitUSD can “outperform” RealUSD by always being cheaper (ie, by consistently missing the target). After all, everyone can afford to have more money.

An essential question is “How much cheaper should BitUSD be?”. The answer is that BitUSD should be cheaper in proportion to its disadvantages.

Those who believe in the blockchain-project (and its BitUSD implementation) can bear the above risks by holding BitUSD, and would be compensated with a return. This return can and should vary with the above risks (but fluctuations in the above-risks/return should be independent of Bitcoin/USD price fluctuations). Those who don’t trust BitUSD, can still make use of it by accepting BitUSD at a discount, then selling BitUSD at a slightly-smaller-discount, and profiting the difference.

Users can trade their current Bitcoin-situation (a 3% chance of a -50% catastrophe) for a guaranteed loss of 15% (the expected value of -50% at 3% likelihood). This guarantee is much more conducive to saving.

In this “insurance market”, users can choose which side of that deal they are on (risk-selling or risk-buying) and can specialize in terms of scale, risk-pooling, and hedging (as insurance providers have always done). Thus, risk-traders (“insurance-entrepreneurs”) compete to reduce the above risks. Their activities generate profits for themselves and price/quality improvements for the public.

Antifragility

Any price fluctuations in BitUSD, far from being bad, generate [1] yield-opportunities for BitUSD-buyers and [2] price signals for BitUSD sellers. These fluctuations promote the use of BitUSD, and as the market-feedback process operates over time, we get specialization, accumulated-experience, and recognize-ability.

A sub-$1 BitUSD still allows individuals to hedge cryptocurrency risk. The only risk they are bearing is the (unavoidable) technical risk.

A Useful Truthcoin-BitUSD

BitUSD might naturally arise in places where the need for a stable currency overlaps with another unmet need (Bitcoin has already “met” the need to transfer USD-value), such as the need for event-derivatives.

Fundamental Value

For every good with a price, there exists some incremental convenience to the buyer.

Traditional BitUSD can’t provide any marginal convenience to the buyer (it competes with two strong players: Bitcoin and USD). However, what needs can neither Bitcoin nor RealUSD meet?

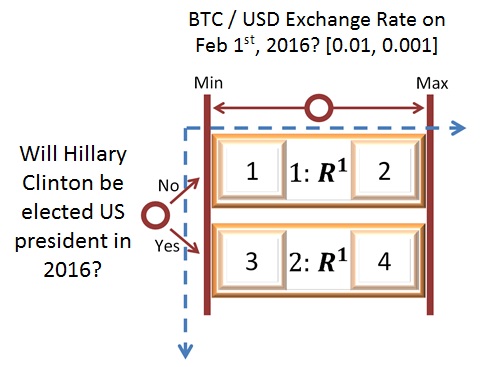

Truthcoin allows one to create a market “priced in dollars”. Because it is currently infeasible to use dollar-based prediction markets, Truthcoin would indirectly create a BitUSD with so-called “fundamental value” (as well as transaction value). Once created, this BitUSD might eventually serve as part of a decentralized exchange, or facilitate Bitcoin to USD exchanges, or otherwise be used solely for its value-stability (and not as part of a secondary prediction). Or, it may never be used for anything else.

Above: A variant of Example 6 from my intro to prediction market types. By buying and selling states 1 and 3, individuals can speculate on Clinton’s presidential chances without exposing themselves to months of a volatile BTC exchange rate.

This “works” for BitUSD, because we must enter the blockchain world (ie, leave the USD world) and remain there for a lengthy duration of cumulative time. We can not use BitPay or exchanges to switch between the RealUSD and Bitcoin. Of course, if censorship-resistant US dollar prediction markets were already available, Truthcoin in general would lose relevance, and so the BitUSD could no longer come into existence this way.

Check Ins: Frequency Doesn’t Matter, Only Accuracy

Let’s examine another shortcoming of the traditional BitUSD of BitsharesX and SchellingCoin: the dangerous and neurotic way each protocol “checks in” with the world to get an update on the BTC/USD exchange rate.

By “check in”, I mean an event where the blockchain-software receives information about the “real” index value (ex: the actual BTC/USD Exchange Rate at a certain time). Does the protocol check in constantly (each block), or “only” every two weeks, or once a year?

![]()

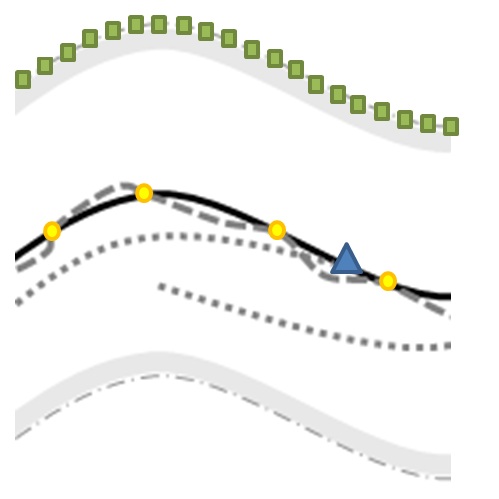

Above: USD Market, priced in BTC (unconventional y-axis direction) to illustrate the concept of “cheaper than normal” BitUSD in the Truthcoin case (blue dots). Over time, the blue and black lines converge (as the relevant risks decrease with proximity to the check-in). For BitsharesX, I emphasize the “guard-rails” in the feed provided by delegates.

Above: “Check-in” events: BitsharesX (green squares) asks each delegate to report constantly, as does SchellingCoin (yellow circles). In contrast, the Truthcoin BitUSD (blue triangle) would wait much longer between reports (several weeks or months). At each check-in, BitUSD and USD would be worth exactly the same (as there is no risk), with the exception of BitsharesX which enforces check-ins differently.

Ignoring Arbitrage

Truthcoin’s seemingly long check in time (of several weeks or months) is a frequent point of confusion for new readers.

( I am afraid that this obsession is as ridiculous as the obsession with Bitcoin’s supposedly “slow” 10 minute interblock-time. Newsflash: it is “bottlenecks in information transfer/processing” [bandwidth, computing speed, etc.] which determine this parameter, not designers. Cutting the interblock-time to 2.5 minutes doesn’t answer the essential question: “Am I getting paid or what?”, just as counting in seconds instead of minutes doesn’t speed the flow of time. )

Once Is Enough (If it’s Good)

Those who know their Finance 101 should already know why the time between resolutions is largely irrelevant: If the ultimate resolution is going to be accurate, then the price will ever and always be tracking the information about each asset’s future value. The law of one price ensures that, even if ‘Asset-X’ isn’t forced to be worth $1 until 6 weeks from now, someone today will buy it for “the present value of that $1”. The $1 is then only diminished by counterparty/protocol risk and time value of money.

A single good check in is enough…the market will do the rest. But now: how to improve the accuracy of the check-in?

Swapping “Useless Frequency” for “Useful Accuracy”

More-frequent “check-ins” are bound to be less-accurate. It is more difficult to manipulate NASA’s GIS temperature data, or Google Finance’s DJIA closing price data, for an entire month than it would be to manipulate either for an entire day.

Manipulations (hacked or intercepted data-sources) will eventually be caught and corrected, so an attacker wants to manipulate data sources for a long cumulative time. If check-ins were once per day, the attacker would want to manipulate the data source for the entire day. If the check-ins were once per week, ideally the attacker would distort the feed for the whole week. The attacker has no way of knowing when the data source will be consulted/double-checked, or when a feed-message will ultimately be sent to the network.

So attackers must worry that [a] the victim would check the feed while it is not being manipulated, or [b] that the manipulation will become noticed and cut off. Both fears increase with check-in time.

Checking in every other block is redundant and dangerous.

Other Mysteries of The Barren BitUSD Landscape

SchellingCoin completely misuses the Schelling Focal Point concept. For example, reporters are not at all indifferent among their choices, and reporters definitely have the ability to enter and leave the game (and attackers would always choose to enter, whereas non-attackers would likely always choose not to enter). It is also critically vulnerable to cheap Sybil attacks. (I give Mr. Vitalik a free pass on these, as his concept was a blog post emphasizing a concept, not a money-making scheme. This community would greatly benefit if other writers restricted their scope in a similarly-appropriate way.)

BitsharesX is so complicated, and undergoes so many design-mutations, and even ownership-changes (where PTS and BTS were separate, merged, re-separated, and then re-merged with multiple other projects) that it is essentially a waste of time for any intelligent person to take a serious look at the project’s bizarre, modularity-defying design (new/untested algorithms for, if you can believe it, ALL of the following: blockchain-consensus, order-matching, margin calls, feed-reporting, BitAsset-trader-incentives).

NuBits has seemingly modeled the US Fed’s open market operations, despite the fact that decentralization is incompatible with the highly-coordinated-and-credible activities of the FOMC (which enjoys almost-perfect investor-confidence as a result of being “the unique leader”). Moreover, they seem to have chosen the disastrous Prompt 1 of “competing feed providers”.

It seems that BitUSD might take a level of design-work comparable to that of Bitcoin itself. Bitcoin, being rolled out quite smoothly, probably made this intensive design-process look easier than it was.

Conclusion

Just stick to the USD and Bitcoin that you know and love.

Just stick to the USD and Bitcoin that you know and love.